what is suta tax on my paycheck

The new law reduces the. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund.

Why Does My Federal Withholding Vary Each Paycheck

For a list of state unemployment tax agencies visit the US.

. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Its a payroll tax that many states impose on employers in order to fund state unemployment. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025.

It is a payroll tax that goes towards the state unemployment fund. The states SUTA wage base is 7000 per. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on.

General employers are liable if they have had a quarterly payroll of 1500. Most employers pay both a Federal and a state unemployment tax. What does Suta mean on my paycheck.

The State Unemployment Tax Act SUTA tax is much more complex. Special Assessment Federal Loan Interest Assessment for. What is SUTA on my paycheck.

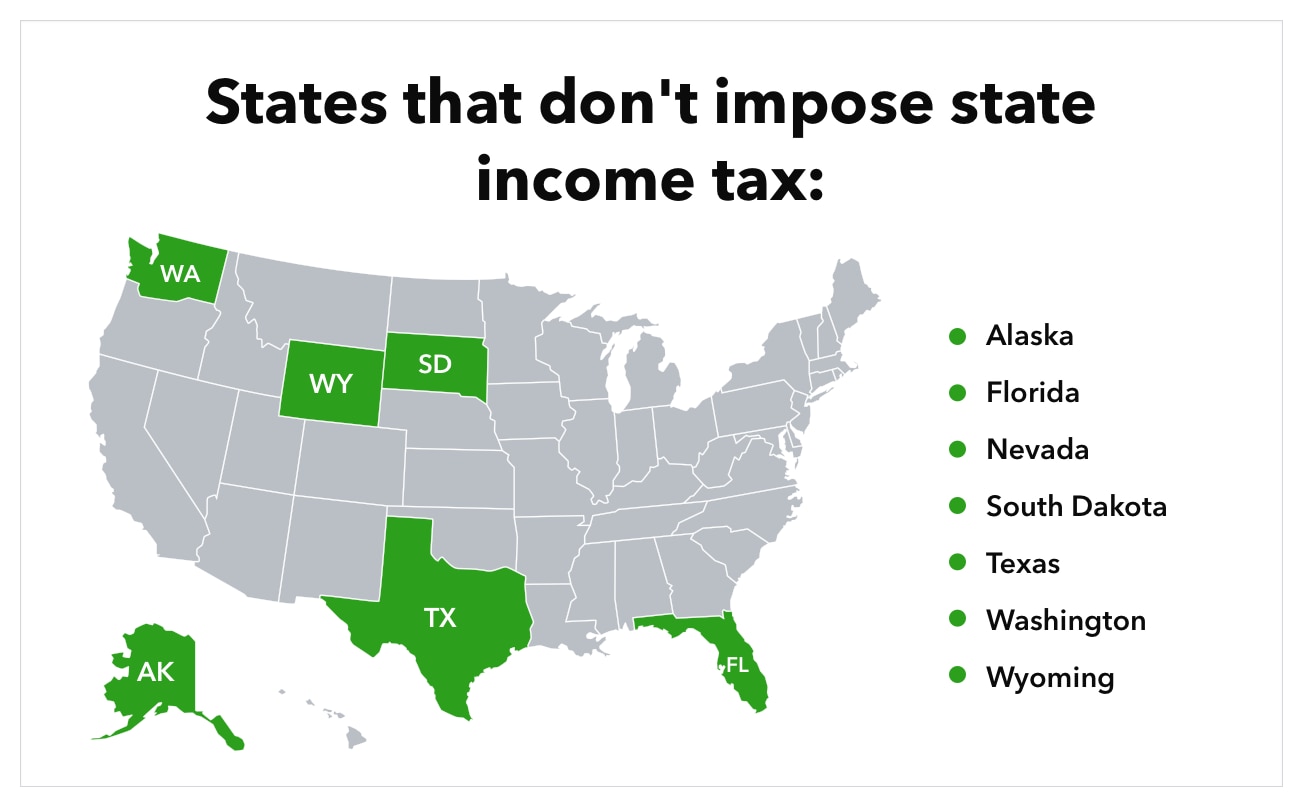

There is no taxable wage limit. Some states require that both. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar year. State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI.

Department of Labors Contacts for State UI. The State Unemployment Tax Act SUTA is essentially FUTA on the state level. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer.

Reemployment tax is paid by employers and the tax collected is deposited into the Unemployment Compensation Trust Fund for the sole purpose of paying. Additional Assessment for 2022 from 1400 to 000. Base Tax Rate for 2022 from 050 to 010.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

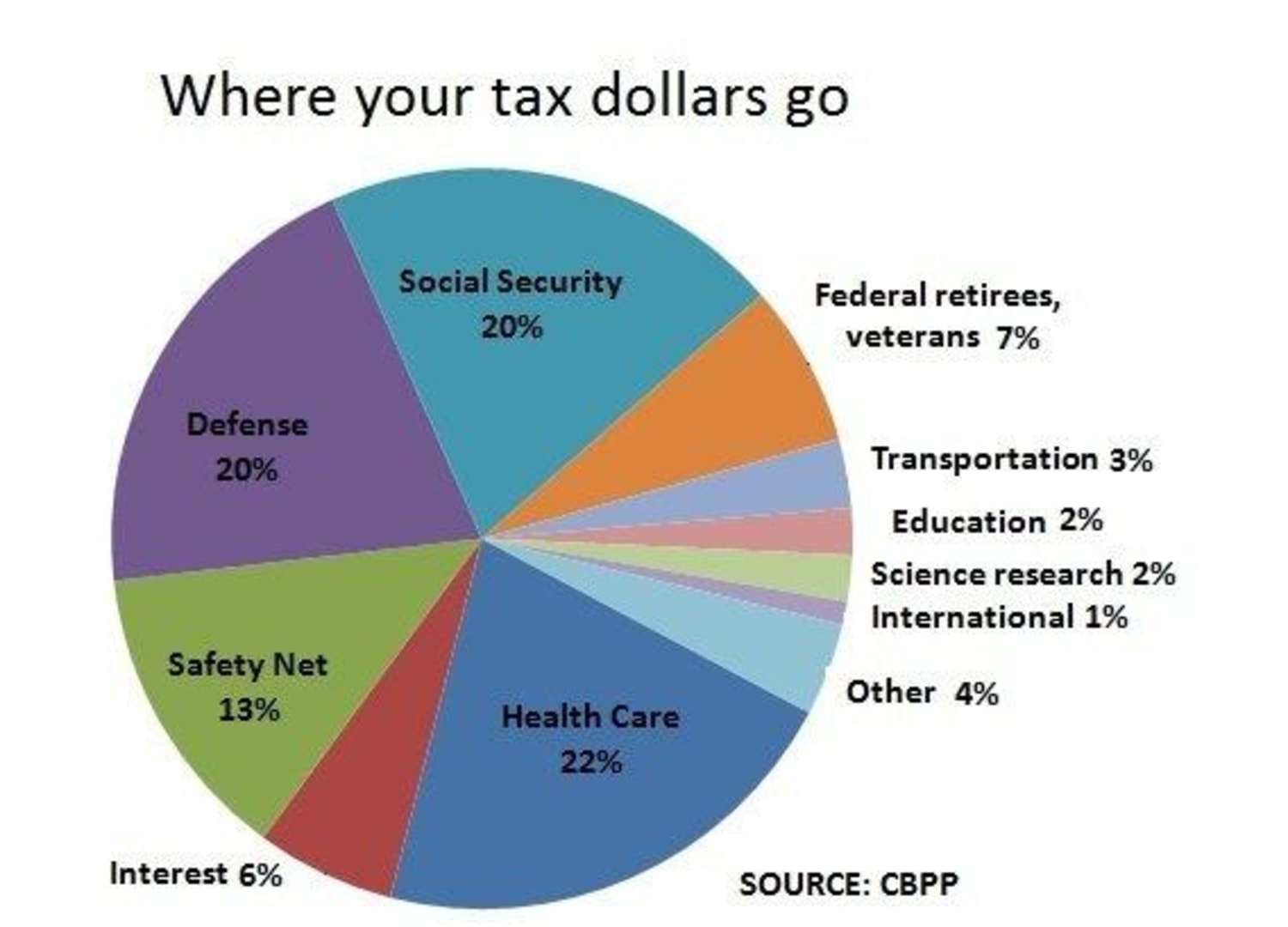

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Paycheck Taxes Federal State Local Withholding H R Block

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

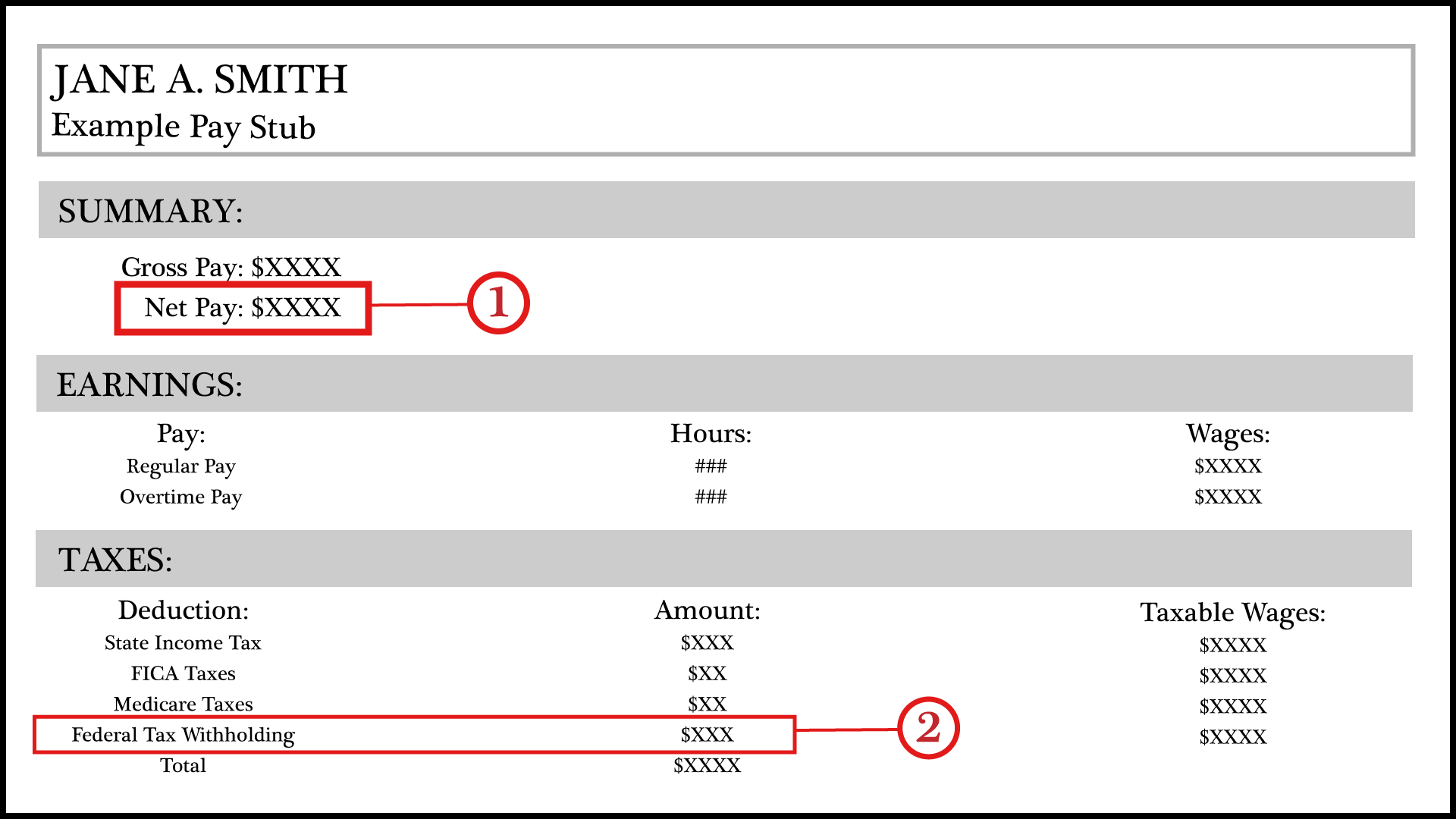

Why Does My Federal Withholding Vary Each Paycheck

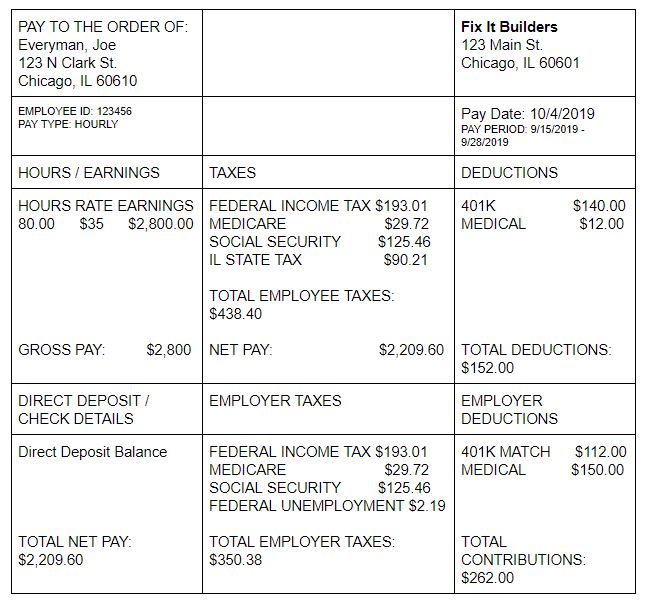

How To Read A Pay Stub Understanding Your Pay Stub Oppu

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes For Your Small Business

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Suta Tax Requirements For Employers State By State Guide

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Explaining Paychecks To Your Employees